A high-yield savings account is a specialized type of savings account that offers significantly higher interest rates compared to traditional savings accounts. These accounts are designed to help you grow your money faster while maintaining the security and ease of access typically associated with standard savings options.

The appeal of a high-yield savings account lies in its ability to provide a risk-free way to accumulate wealth, making it an excellent choice for both short-term and long-term financial goals.

Unlike other savings vehicles, such as CDs (Certificates of Deposit) or investment accounts, high-yield savings accounts do not lock your money away for a fixed period. This flexibility allows you to access your funds whenever you need them, while still benefiting from higher interest rates. Additionally, the best high-yield savings accounts are offered by both online and brick-and-mortar banks, giving you a wide range of options to suit your personal preferences and banking needs.

The importance of selecting the right high-yield savings account cannot be overstated. With interest rates varying widely among different institutions, choosing the best account can make a substantial difference in how much interest you earn over time. In this guide, we will explore some of the top high-yield savings accounts available today, discussing their features, benefits, and what makes them stand out from the competition.

Top High-Yield Savings Accounts

Ally Bank

Ally Bank is well-known for its customer-friendly approach and competitive financial products, and its high-yield savings account is no exception. Offering an impressive 4.00% APY, Ally Bank stands out as one of the top contenders in the high-yield savings market. The lack of monthly maintenance fees is a significant advantage, allowing your savings to grow without any deductions that could eat into your earnings.

Another noteworthy feature of Ally Bank’s high-yield savings account is the seamless online banking experience it offers. With a user-friendly interface, the Ally Bank app provides tools for tracking your savings goals, transferring funds, and monitoring your account activity in real time. For those who prefer to manage their finances digitally, Ally Bank’s platform is both robust and intuitive.

Ally Bank also offers round-the-clock customer support, ensuring that help is available whenever you need it. This can be especially reassuring for customers who may need assistance outside of regular banking hours. In addition to its high APY and excellent customer service, Ally Bank occasionally runs promotions, offering new customers bonuses for meeting specific deposit requirements. These promotions can give your savings an extra boost, making Ally Bank an attractive option for those looking to maximize their returns.

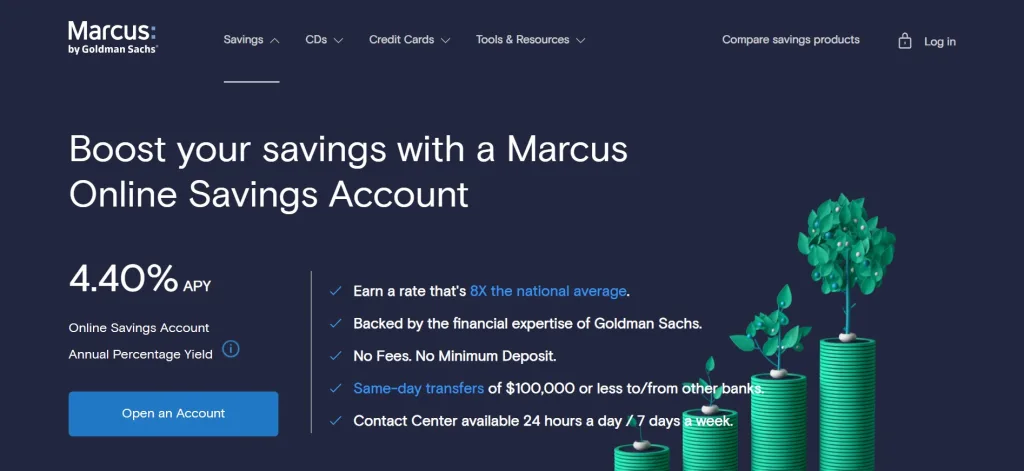

Marcus by Goldman Sachs

Marcus by Goldman Sachs has quickly become a popular choice for savers seeking a straightforward, no-frills high-yield savings account. With an APY of 3.90%, Marcus offers a competitive rate that, while slightly lower than Ally Bank, still provides excellent growth potential for your savings. One of the key advantages of Marcus is its simplicity—there are no fees, no minimum deposit requirements, and no complex account tiers to navigate.

The Marcus by Goldman Sachs high-yield savings account is designed for individuals who value a hassle-free banking experience. The account’s simplicity does not mean a lack of features, however.

Marcus offers a secure online platform where customers can easily manage their savings, set up automatic transfers, and monitor their account balance. While Marcus does not offer ATM access, funds can be easily transferred to an external bank account when needed, usually within one to two business days.

Another factor that sets Marcus apart is the backing of Goldman Sachs, a prestigious financial institution with a long history of stability and expertise. This association provides an added layer of confidence for customers who prioritize security in their banking choices.

While Marcus may not offer the highest APY on the market, its combination of competitive rates, fee-free structure, and reputable backing make it a solid choice for anyone looking to grow their savings without unnecessary complications.

Discover Bank

Discover Bank is a well-established name in the financial industry, and its high-yield savings account is a testament to the bank’s commitment to offering value to its customers. With an APY of 3.85%, Discover’s high-yield savings account is slightly below those offered by Ally and Marcus, but it compensates with a range of additional benefits that enhance its appeal.

One of the most attractive features of Discover Bank’s high-yield savings account is its zero-fee policy. Unlike some banks that charge fees for various services, Discover Bank eliminates these costs entirely, ensuring that your savings can grow without any hidden deductions.

This no-fee approach extends to all aspects of the account, including transfers, maintenance, and even incoming wire transfers, making it a truly cost-effective option.

Discover Bank also offers a user-friendly mobile app that is highly rated by customers for its ease of use and functionality.The app allows you to manage your savings on the go, with features such as mobile check deposit, account alerts, and budgeting tools.

Additionally, Discover Bank frequently runs promotions for new customers, such as offering a $150 bonus for depositing at least $15,000 within the first 30 days of account opening. These bonuses can provide a significant boost to your initial savings and make Discover a compelling choice for those looking to maximize their earnings.

In comparison to Ally and Marcus, Discover Bank offers a balanced approach, combining competitive rates with additional perks and a strong focus on customer satisfaction.

While its APY may not be the highest, the overall value provided by Discover Bank makes it a worthy contender for anyone seeking a reliable and rewarding high-yield savings account.

Factors to Consider

When choosing the best high-yield savings account, several factors should be taken into account to ensure that the account aligns with your financial goals and needs:

- Interest Rates: The primary reason for choosing a high-yield savings account is the opportunity to earn more interest on your savings. Therefore, the APY offered by the bank is a critical factor. While higher rates are generally better, it’s also important to consider the stability of those rates. Some banks may offer promotional rates that decrease after a certain period, so it’s essential to understand the terms and ensure that the rate will remain competitive over time.

- Fees: Monthly maintenance fees, transaction fees, and other charges can quickly erode the interest you earn. When comparing high-yield savings accounts, look for banks that minimize or eliminate these fees. Many top banks, like Ally, Marcus, and Discover, offer fee-free accounts, which help ensure that your savings grow as efficiently as possible.

- Accessibility: Depending on your financial habits, the ease of accessing your funds may be a significant consideration. Some high-yield savings accounts offer ATM access, which allows for quick cash withdrawals, while others may only allow transfers to an external account. Consider how often you anticipate needing to access your savings and choose an account that aligns with your needs.

- Customer Service: Good customer support can be crucial, especially if you encounter issues with your account. Banks that offer 24/7 customer service, like Ally, provide added peace of mind, knowing that help is available whenever you need it.

- FDIC Insurance: Ensure that the bank is FDIC insured, which guarantees your deposits up to $250,000 per account holder. This insurance provides a safety net, ensuring that your money is protected in the unlikely event that the bank fails.

Tips for Maximizing Your Savings

To make the most of your high-yield savings account, consider the following strategies:

- Maintain a High Balance: The more money you have in the account, the more interest you’ll earn. Setting up automatic transfers from your checking account to your high-yield savings account can help you consistently grow your balance without having to think about it. Some banks also offer higher interest rates for larger balances, so keeping more money in your account can lead to even greater earnings.

- Avoid Withdrawals: Try to minimize withdrawals from your high-yield savings account to allow your savings to compound more effectively. The power of compound interest means that the longer your money stays in the account, the more it will grow. If you find yourself needing to access your savings frequently, consider setting up a separate account for emergency funds to avoid dipping into your high-yield savings.

- Take Advantage of Promotions: Some banks offer bonuses for new accounts or specific deposit amounts, which can give your savings a quick boost. These promotions often require meeting certain criteria, such as maintaining a minimum balance or setting up direct deposits. Be sure to read the terms carefully and take advantage of any offers that align with your financial situation.

- Regularly Review Your Account: Interest rates can change over time, so it’s a good idea to periodically review your high-yield savings account to ensure it remains competitive. If a better option becomes available, consider transferring your funds to take advantage of higher rates or better features.

Final Thought

When choosing the best high-yield savings account, it’s essential to compare options based on your financial goals and preferences. Ally Bank offers the highest interest rate with no fees, Marcus by Goldman Sachs provides a straightforward experience with competitive rates, and Discover Bank balances attractive rates with added bonuses.

Each of these accounts has its strengths, and the best choice for you will depend on your specific needs and financial habits.

By carefully evaluating your options and considering factors such as interest rates, fees, and accessibility, you can select the high-yield savings account that will help you grow your savings most effectively.