A good credit score opens doors to better financial opportunities, such as lower interest rates on loans and higher chances of credit approval. Improving your credit score fast might seem challenging, but with the right strategies, you can see significant improvements in a short period. Here are some effective methods to boost your credit score quickly.

Importance of a Good Credit Score

A high credit score is crucial for obtaining favorable loan terms and accessing premium credit cards. It reflects your creditworthiness and financial responsibility. A poor credit score can limit your financial options and result in higher interest rates, costing you more in the long run. Beyond loans and credit cards, a good credit score can also affect other aspects of your life, such as renting an apartment, getting favorable insurance rates, and even some employment opportunities. Many landlords and employers consider your credit score a reflection of your overall reliability and financial stability. Hence, maintaining a good score is essential for a broader range of life’s opportunities.

Methods to Improve Your Credit Score Fast

To improve your credit score fast, focus on checking your credit report, reducing credit card balances, avoiding late payments, increasing your credit limit, diversifying your credit mix, and using credit responsibly. Each of these steps requires careful planning and consistent effort, but the results are well worth the commitment. By understanding and implementing these strategies, you can take control of your financial future and achieve a healthier credit score.

1. Check Your Credit Report

How to Obtain and Review Your Credit Report

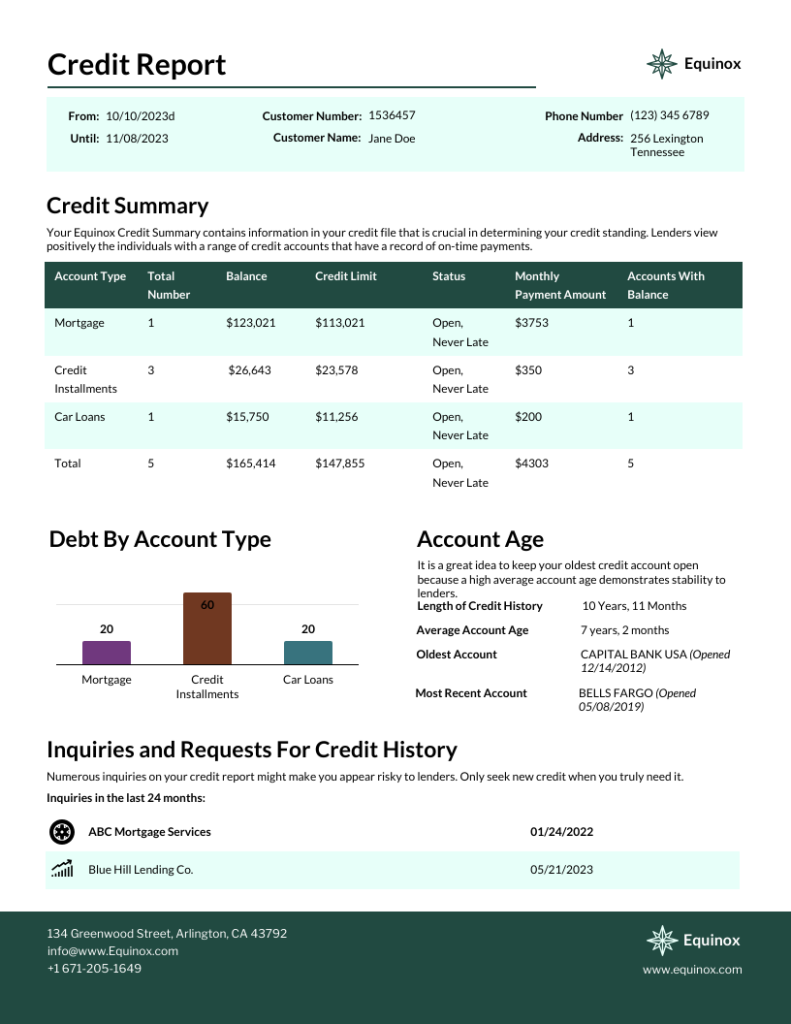

Start by getting a copy of your credit report from the three major credit bureaus: Equifax, Experian, and TransUnion. You can obtain a free report annually from each bureau through AnnualCreditReport.com. Carefully review each report for accuracy. Reviewing your credit report regularly allows you to spot any inaccuracies or suspicious activities that could harm your credit score. It’s also an opportunity to understand the factors contributing to your current score and identify areas for improvement.

Identifying and Correcting Errors

Errors on your credit report can drag down your score. Look for mistakes such as incorrect personal information, accounts that aren’t yours, or inaccurate payment statuses. Dispute any errors with the credit bureau by providing documentation to support your claim. The dispute process can be done online, by mail, or over the phone, and the credit bureau is required to investigate and respond within 30 days. Correcting these errors can lead to a swift improvement in your credit score. Additionally, monitoring your credit report regularly helps you catch identity theft early, which can save you from significant financial damage and prolonged efforts to restore your credit.

2. Reduce Credit Card Balances

Strategies for Paying Down Debt

High credit card balances negatively affect your credit score. Focus on paying down your debts by prioritizing high-interest accounts first. Consider using the snowball or avalanche method to tackle your balances efficiently. The snowball method involves paying off your smallest debts first, providing quick wins and motivation, while the avalanche method focuses on paying off debts with the highest interest rates first, saving you more money in the long run. Both methods can be effective, so choose the one that best suits your financial situation and goals. In addition to these strategies, consider consolidating your debts with a personal loan at a lower interest rate, which can simplify payments and reduce the total interest paid over time.

Benefits of Maintaining Low Credit Utilization

Keeping your credit utilization ratio below 30% of your total available credit is beneficial. For example, if your credit limit is $10,000, aim to keep your balance under $3,000. This ratio significantly impacts your credit score. Low credit utilization shows lenders that you’re not overly reliant on credit and can manage your spending. To maintain a low utilization rate, make a habit of paying off your balances in full each month or making multiple payments throughout the month. Another useful tip is to ask your credit card issuer to change your payment due date to better align with your cash flow, making it easier to pay down balances before the statement closing date.

3. Avoid Late Payments

Setting Up Automatic Payments or Reminders

Late payments can severely damage your credit score. Set up automatic payments through your bank or credit card issuer to ensure bills are paid on time. Alternatively, use reminders on your phone or calendar to avoid missing due dates. Automating your payments reduces the risk of human error and ensures that your bills are always paid promptly. If automation isn’t an option, setting up reminders a few days before the due date can help you stay on top of your payments. Additionally, consider organizing your bills and payment schedules in a financial planning app, which can offer comprehensive tracking and alerts.

Impact of Late Payments on Your Score

Even one late payment can cause a significant drop in your credit score. Consistently paying your bills on time is one of the most important factors in maintaining and improving your credit score. The longer a payment is overdue, the more it will hurt your score. Therefore, prioritize timely payments to avoid negative marks on your credit report. If you have trouble remembering due dates, consider consolidating your bills or adjusting due dates to better align with your pay schedule. Establishing a financial routine, such as reviewing your accounts weekly, can help you catch upcoming due dates and ensure you have sufficient funds available.

4. Increase Your Credit Limit

How Increasing Your Credit Limit Can Help

Requesting a higher credit limit can lower your credit utilization ratio, which can positively impact your credit score. This strategy works best if you maintain your current spending levels and don’t accumulate additional debt. A higher credit limit gives you more available credit, reducing your utilization rate and improving your credit score. However, this approach requires discipline to avoid the temptation of increasing your spending. If used wisely, it can provide a buffer that helps you manage unexpected expenses without resorting to high credit utilization.

Requesting a Limit Increase Responsibly

When requesting a credit limit increase, ensure your account is in good standing. Contact your credit card issuer and provide reasons for the increase, such as an improved income or long-term account history. Avoid frequent requests as they can trigger hard inquiries, which may temporarily lower your score. A hard inquiry occurs when a lender reviews your credit report as part of a credit application. Too many hard inquiries in a short period can signal to lenders that you’re a high-risk borrower, so make limit increase requests sparingly and strategically. Additionally, consider asking your issuer if a limit increase can be done without a hard inquiry, as some may offer this option based on your account history.

5. Diversify Your Credit Mix

Understanding Different Types of Credit Accounts

Having a mix of credit types, such as credit cards, mortgages, and installment loans, can enhance your credit score. Lenders like to see that you can manage various types of credit responsibly. Different types of credit demonstrate your ability to handle different financial obligations. Installment loans, such as car loans and mortgages, involve regular, fixed payments, while revolving credit, like credit cards, requires managing variable balances. Diversifying your credit mix shows lenders that you’re capable of managing both fixed and flexible financial commitments.

How Having a Variety of Credit Accounts Can Benefit Your Score

A diverse credit portfolio shows that you can handle multiple credit responsibilities. This variety can positively influence your credit score, especially if all accounts are managed well. Having a good mix of credit accounts suggests to lenders that you’re a responsible borrower who can manage different types of credit products effectively. If you only have one type of credit, consider adding another type, such as a small personal loan or a secured credit card, to diversify your credit profile. This can be particularly useful for those with limited credit histories, as it helps build a more robust credit profile that reflects a range of financial experiences.

6. Use Credit Responsibly

Best Practices for Using Credit Cards

Use your credit cards wisely by making purchases you can afford to pay off in full each month. This habit helps you avoid interest charges and keeps your credit utilization low. Additionally, paying off your balances in full shows lenders that you’re financially responsible and can manage your credit well. Regularly reviewing your credit card statements can help you track your spending and ensure that you stay within your budget. Consider setting personal spending limits that are below your actual credit limits to further control your spending and prevent overextending your finances.

Avoiding Unnecessary Debt

Avoid taking on unnecessary debt by only using credit when necessary. Plan your purchases and avoid impulsive spending. Staying within your means is key to maintaining a healthy credit score. Creating and sticking to a budget can help you manage your finances and avoid overspending. Before making a purchase on credit, ask yourself if it’s something you truly need and if you can afford to pay it off quickly. This disciplined approach to spending will help you build a strong credit history and avoid the pitfalls of debt accumulation. Additionally, consider using cash or debit cards for everyday purchases to keep your credit card balances low.

Final Thought

Improving your credit score fast requires a strategic approach. By checking your credit report, reducing credit card balances, avoiding late payments, increasing your credit limit, diversifying your credit mix, and using credit responsibly, you can achieve a better score. Regularly monitor your credit to track your progress and stay informed about your financial health.

Making these practices a part of your routine can lead to lasting improvements in your credit score and overall financial well-being. Remember, a higher credit score opens up more opportunities and provides greater financial flexibility, so the effort you put into improving it is well worth it.

Additionally, educating yourself about credit and financial management can further enhance your ability to maintain a good credit score and make informed financial decisions in the future. Take advantage of resources such as financial literacy courses, credit counseling services, and reputable financial advice websites to continue growing your knowledge and skills.